👋 Hi, I’m Andre and welcome to my weekly newsletter, Data-driven VC. Every Tuesday, I publish “Insights” to digest the most relevant startup research & reports, and every Thursday, I publish “Essays” that cover hands-on insights about data-driven innovation & AI in VC. Follow along to understand how startup investing becomes more data-driven, why it matters, and what it means for you.

Current subscribers: 21,050, +170 since last week

Brought to you by VESTBERRY - Portfolio Intelligence Platform for Data-driven VCs

The Pale blue dot (PBD) team spent days creating internal LP reports from over 20 sheets full of fund data and performance metrics. With growing operations, the work only piled on. Sounds familiar?

Take 5 minutes to read this case study and find out how PBD cut reporting workload by over 75% without sacrificing quality.

What Makes a VC Successful?

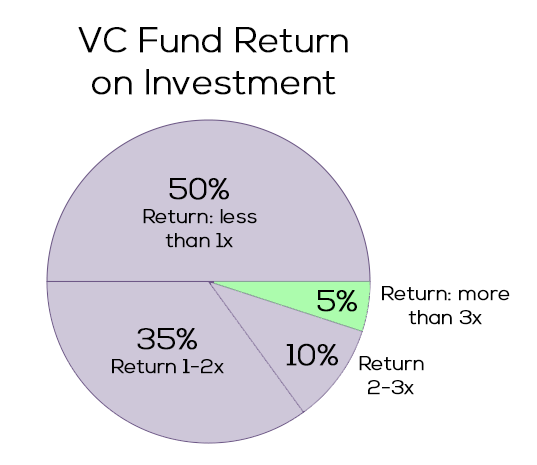

“Beauty is in the eye of the beholder” also holds true for VC success. Although we have been observing a shift from a pure financial return perspective to a more holistic ESG-centered one, the majority of GPs still operate with return on investment (ROI) top of their minds.

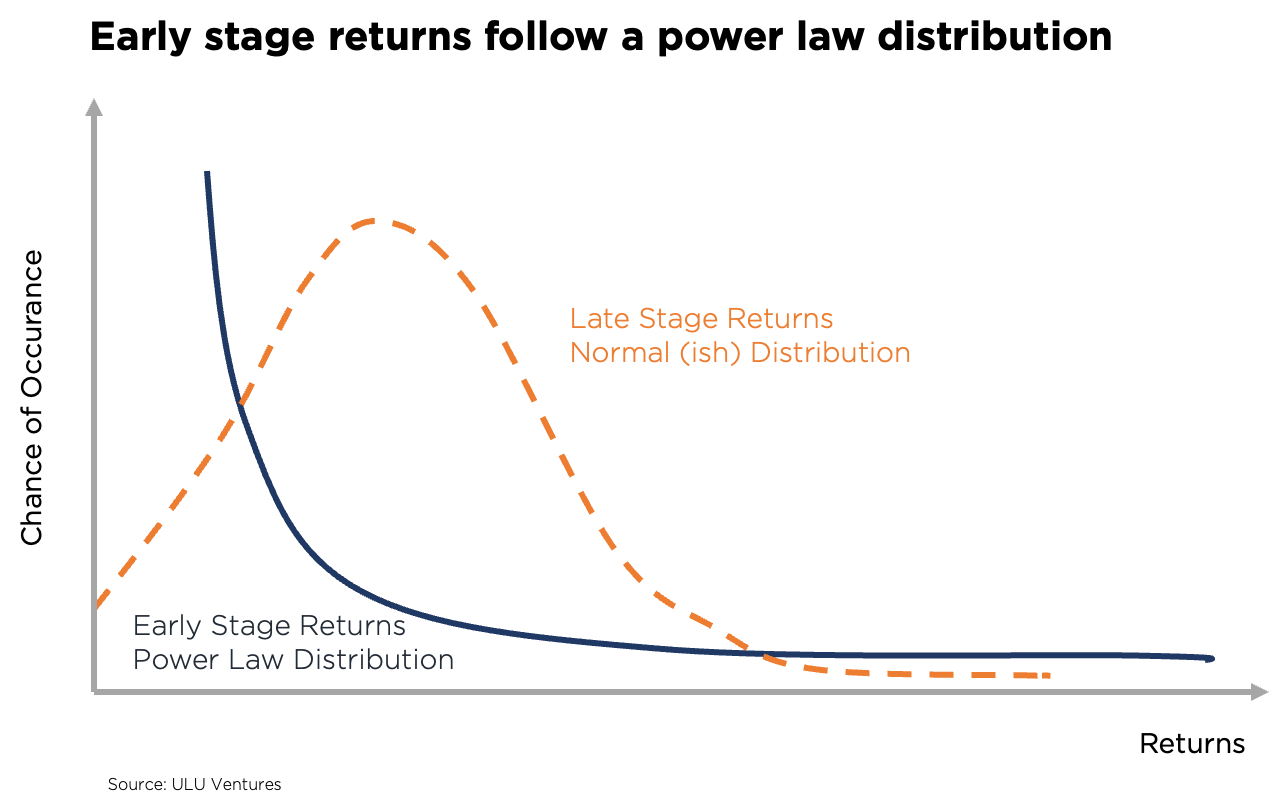

On a portfolio level, early-stage VC returns are distributed based on a Power-law, whereas later-stage and private equity (PE) returns follow a normal distribution. In line with the most well-known Power-law distribution, the Pareto Principle (or “80-20-rule”), early-stage VC returns are driven by a high alpha coefficient that leads to oftentimes only 10% or less of the portfolio delivering 90%+ of the returns.

Consequently, a well-performing early-stage VC fund with a portfolio of 25-35 startups depends on one or two outlier IPOs or trade sales and is comparably insensitive to write-offs. Said differently, early-stage VCs are upside-oriented, whereas growth VCs and PEs rather try to limit their downside.

In turn, every VC investment needs to have the potential to become one of the few outliers. I shared my thoughts and a rule of thumb on how big your startup needs to become to be a VC investment case here.

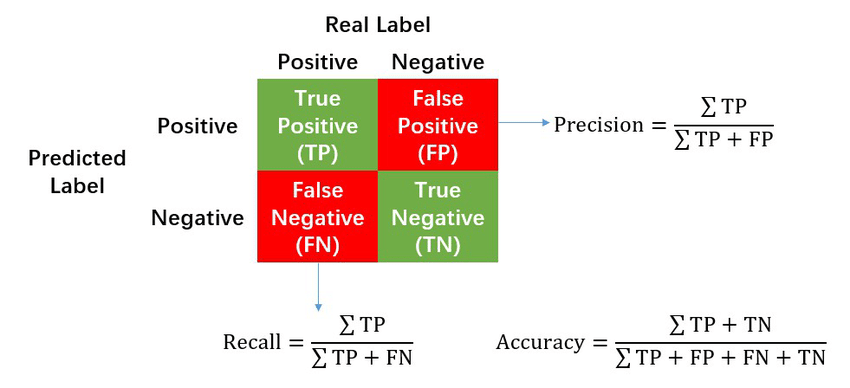

While early-stage VCs can afford to write off a significant portion of their portfolio, they cannot afford to miss an outlier. Translated into data speech: VCs face an asymmetric cost matrix where false positives (FP=decide to invest but need to write it off later) are OK/less costly as they can lose their money only once, but where false negatives (FN=decide to not invest but turns out to be a multi-billion dollar company later) are NOT OK/more costly as they miss an opportunity to multiply their money several times.

Obviously, VCs could decrease FN by investing in every company but in reality, they face natural limitations such as a) how many companies a human VC can look into more detail for screening and b) how many companies a VC can invest in given a fixed fund size, clear split of initial versus follow-on allocation and approximate target with respect to the number of companies in mind. Therefore, a successful VC needs to improve recall (=reduce false negatives) with a fixed number of investments as a limitation.

Cutting Through the Noise

How can VCs improve recall while being sensitive to capital constraints? Having spoken to hundreds of VC firms about their screening processes (partially throughout my PhD research, partially thereafter; detailed overview in my paper here pg11-14), I identified two important screening dimensions and four major groups of screening approaches. Let’s find the needle in the haystack!